Tax Increment Finance District

Welcome!

West Linn is working to set a vision for the Waterfront area around the Historic Arch Bridge all the way to the Willamette Area. The Council and community also have a vision for the Historic Willamette Main Street area and the Commercial District north of I-205 off of Blankenship Road. To support all of this, planning for financing of public improvements in these areas is critical.

What is Tax Increment Financing/Urban Renewal?

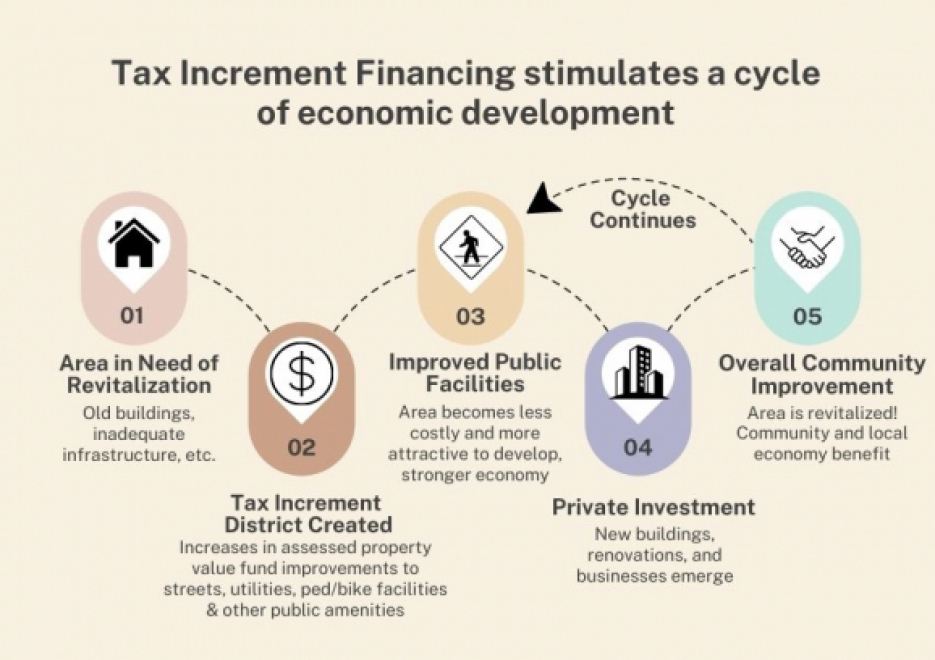

Tax increment financing (TIF), sometimes referred to as Urban Renewal, is a financing tool that local governments can use to fund public infrastructure in targeted areas in need of revitalization to encourage private development and investment. A local government can designate an “increment area” surrounding the site of the proposed public improvements. As the city and others invest in the urban renewal (or “increment”) area, property values go up. The property tax portion of increases in the assessed value of properties within the increment area is then allocated towards paying for those public improvement enhancements.

Tax increment financing does not raise property taxes and their is no impact on taxpayers, rather it dedicates a share of existing taxes to infrastructure projects as described above. It does not add to West Linn residents' tax bills, it divides from the existing tax bill and the reduces tax revenue to overlapping tax districts. The West Linn City Council will run the District and ensure that all expenditures are appropriate and coordinated with community goals.

Tax Increment Financing in West Linn

West Linn created their first ever TIF district in 2023 in the Waterfront area (from the Arch Bridge to the Willamette Neighborhood), Historic Willamette Main Street area, and Commercial District north of I-205 on Blankenship Road. The development of an infrastructure financing plan is critical as a number of public improvements that will be necessary to jumpstart the creation of the community’s vision for these areas. Tax increment financing was seen by Council and staff as a good source of funding to move towards the goal of revitalizing these key areas of the City.

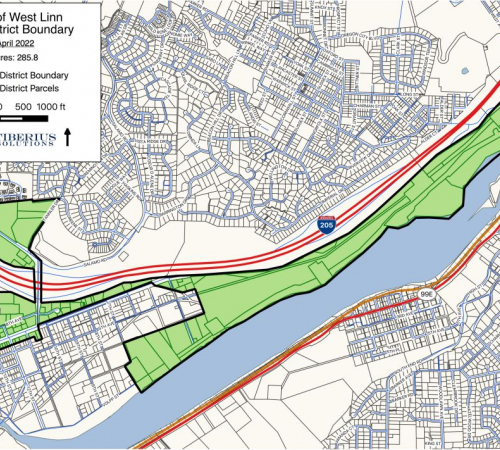

The West Linn Willamette TIF Area Plan Area, shown in Figure 1 in the TIF Plan available below, consists of approximately 333.8 acres, which is composed of 161 individual parcels encompassing 197.41 acres, and an additional 136.30 acres in public rights-of-way. It is anticipated that the West Linn Willamette TIF Area Plan will take thirty years of tax increment collections to implement. The maximum amount of indebtedness that may be issued for the Plan is not to exceed $76,100,000 (Seventy-Six Million One Hundred Thousand dollars). Detailed financial analysis is in the Report Accompanying the West Linn Willamette Riverfront Tax Increment Plan available below.

The West Linn Urban Renewal Advisory Committee met three times and reviewed materials for this TIF Plan including the boundary, projects list and financial information The Advisory Committee met on October 18, 2022 and made recommendations to Council through a vote of the committee (taxing district representatives from TVFR and WLWV School District abstained from voting as did a Planning Commission Representative as the Plan was also reviewed at the Planning Commission level).

Learn more about West Linn's path towards tax increment districting in the areas at the links below

Milestones

The City Council adopted a tax increment financing district in 2023 (see map below), including the Waterfront Planning Area, Historic Willamette Commercial District, and the Commercial District north of I-205. A final TIF Report has been produced by our consulting team, this report includes a detailed analysis of anticipated funding amounts and information on the proposed projects that could be funded using TIF dollars. The process for approval included the following steps, in accordance with ORS 457.

April 10, 2023: West Linn Redevelopment Agency (City Council) met to appoint officers and move the urban renewal plan forward. The proposed Plan and Report was sent to the affected taxing districts on April 11. This letter is the official notification and starts the required “consult and confer” process.

May 3, 2023: Required Planning Commission Hearing on the draft Plan's conformance to the West Linn Comprehensive Plan and Planning Commission recommendation to City Council.

May 2023: The Clackamas County Board of Commissioners were briefed on the draft Plan and Report in May.

June 12, 2023: Council hearing on final action to formally adopt the new urban renewal district. Staff sent out a notice advertising this hearing to all West Linn utility customers pursuant to ORS 457. This hearing by West Linn City Council and adoption of the proposed Plan and accompanying Report was by a non-emergency ordinance. The ordinance must be a non-emergency ordinance, which means that the ordinance does not take effect until 30 days after its approval and during that period of time may be referred to West Linn voters if a sufficient number of signatures are obtained on a referral petition.